Blog

TalentPro’s Human Resources blog is a knowledge portal where we discuss the latest and best practices related to the Human Resources Industry. The portal educates the reader in various areas of interest such as Payroll, Compliances, Staffing, Human Resource Management Services (HRMS), Recruiting, etc.

Blog categories

How to create the perfect work from home policy for your company

A perfect “work from home policy” is perhaps the need of the hour, and also, a corporate should have a contingency plan of work from home for its employees in times of need. Let us see some of how a…

Managing Your Workforce in a Lockdown

The world’s economy is currently experiencing a massive crisis in the form of SARS-CoV-2. Apart from the staggering toll it has taken in terms of its victims, and the crisis has also impacted the way businesses and organizations work. Businesses…

How Payroll Management varies for different sectors

Payroll is a very strategic aspect of any business organization, and as such, every industry sector lays great emphasis on its successful implementation. Payroll processing services is a very strategic corporate function these days. Every business, big or small, needs…

Preparing the Workforce for the End of the Financial Year

The financial year is a standard one-year time period during which business is conducted. Organizations will have to submit balance sheets and income statements and other financial records to the government of India. The date with which the financial year…

2030 and the Future of the Labour Market

The world’s marketplaces are constantly evolving and it remains to be seen what is in store for the way business and work is conducted. Organizations are beginning to adopt newer practices and trends to stay ahead of their competitors. Key…

Why is a good workplace culture important?

For a business to flourish and realize its aims, the foremost requirement is that of a good workplace. Good workplace culture is very important not only for an employee but for the employer as well. When we talk about the…

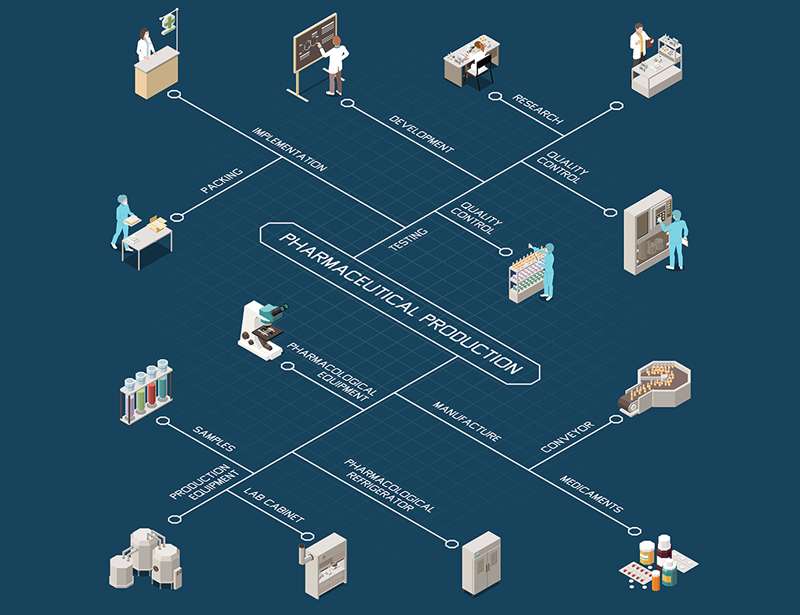

Top 7 payroll issues for the pharmaceutical industry

For any industry, Payroll processing services are essential. The pharmaceutical industry in India is facing multiple issues when it comes to payroll. For any business organization, payroll is a very strategic function that requires careful attention and good skills. Read more: (Statutory compliance checklist for manufacturing companies) Some of the major issues faced by the pharmaceutical industry, as far as payroll is concerned: Issues related to Non – ComplianceThis may be…

Adapting to the New Normal – A Guide for Managers

The CoVID-19 crisis has affected the way organizations view and do business globally. Companies and employers have had to ensure that their workflow and processes remain unaffected. Newer systems have been implemented that have enabled employees to continue delivering quality output that remains relatively unaffected by the CoVID crisis. There will be a new normal in HR services as well. Managers will have to look at areas that were not paid the same…

Do IT Techs Need to Get Back to Campus?

IT professionals constitute a very vital part of the Indian economy, and no doubt, this COVID – 19 crisis has hit hard in the IT sector. However, the companies are looking forward to workforce management as life turns to normal slowly. The Covid-19 crisis started to hamper the economy from the March-end, and ultimately the IT/ITES companies were forced to offer “work from home” option to their employees. The companies…

Ways for an Effective HR Management in Small Businesses

Management of a business can be a challenge to any business owner, especially when it comes to small businesses; it’s even trickier. A proper plan for the future keeps you away from bad financial habits, which may harm your business. Being a business owner, clearly understanding the underlying processes to run a small business such as HR management, is essential. Here are some of the ways that you should know…

Income Tax Slabs 2020-India

Income Tax Slabs 2020 India Let’s take a quick brush-up of the Income Tax Slabs 2020 in India & explore how the income tax slabs, surcharges, and deduction limits have changed over the past nine years.

Understanding Software as a Service (SaaS)

SaaS can be referred to as Software as a service. Here, the user doesn’t pay for the Software itself; instead, it can work as a rental service. The user can have the authorization to access it for a certain period and pay for using the Software. In general, a SaaS service provider offers a wide range of services in different sectors like managed payroll processing in HR, etc. It’s like just getting…

Featured posts

What is third party Payroll? A complete guide by TalentPro

Statutory compliance checklist 2026

A complete guide to statutory compliance in HR: Meaning, importance & key requirements